Who's afraid of qualitatively weighted metrics?

ArtReview

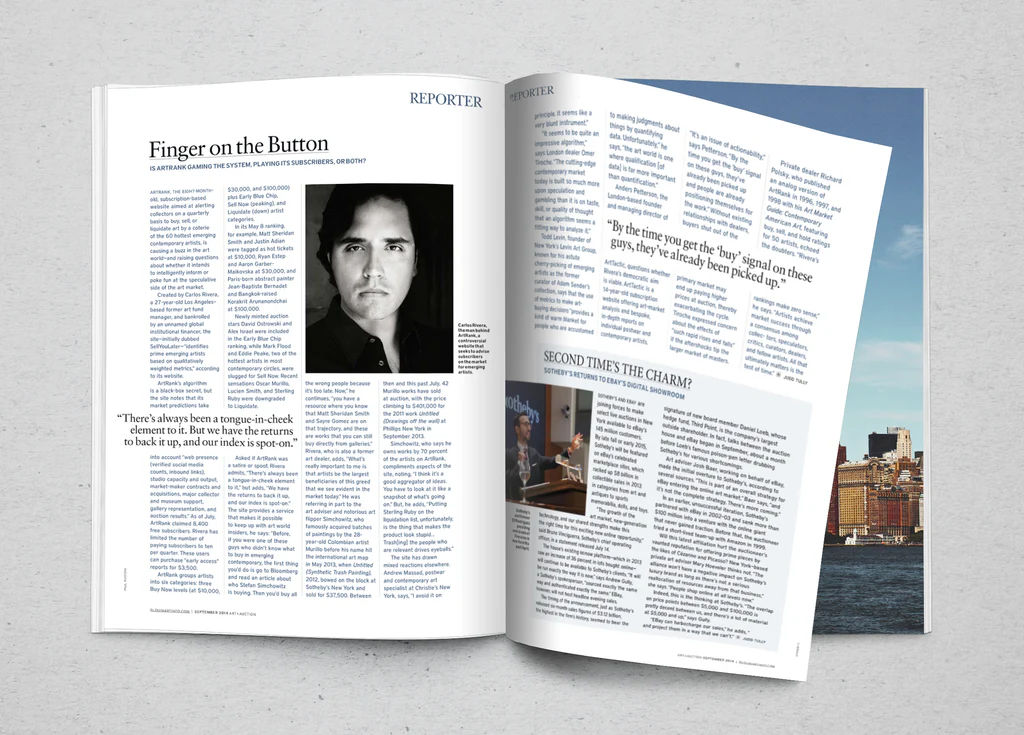

Funny, Matisse said nearly the same thing about Picasso’s Demoiselles. Well, he actually called it Picasso’s hoax, and in those terms, sellyoulater.com may be the most modernist of art-market sites. It is spare, yellow, gridded, like Mondrian’s Broadway minus the Boogie-Woogie, and it’s bent on confrontation. Its wager appears to be that intrigue and outrage are enough to drive traffic, gain attention and, presumably, at some point, turn a profit. If Artnet can sell its reports on individual artist’s markets for $186 each, and Josh Baer can charge $250 for a subscription to his insider-ish ‘industry newsletter’, then there is money to be made as a purveyor of art-trading data, and perhaps even more if one’s methodology remains proprietary. Placebo effects aside, do you still call it ‘snake oil’ if it works?